Journal

10/02/2026

10/02/2026Foreign social security contributions deductible from conventional salaries

27/01/2026

27/01/2026Corporate Residency: the burden of proof lies with the Tax Authorities

13/01/2026

13/01/2026Taxation of dividends: the new 10% threshold for income exclusion is now effective in Italy

08/01/2026

08/01/2026Crypto-assets: Italian tax crackdown with 33% rates and total monitoring

05/11/2025

05/11/2025The Italian Tax Regime for Holders of Crypto-Assets: Recent Legislative Developments

28/10/2025

28/10/2025Artificial Intelligence in Swiss SMEs: the real challenge is legal leadership, not technological.

15/10/2025

15/10/2025US Trust and Beneficiaries in Italy: Taxation by Transparency

07/10/2025

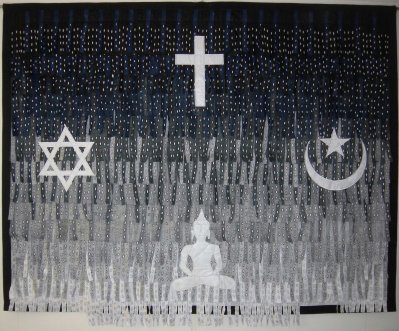

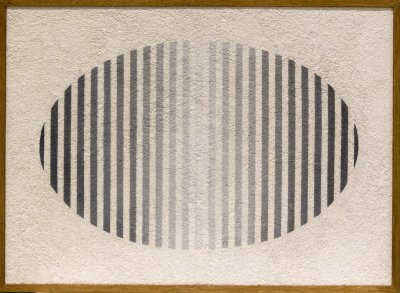

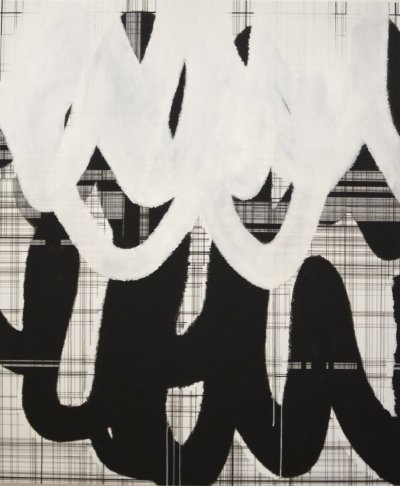

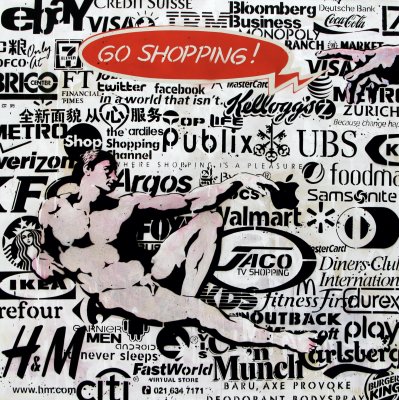

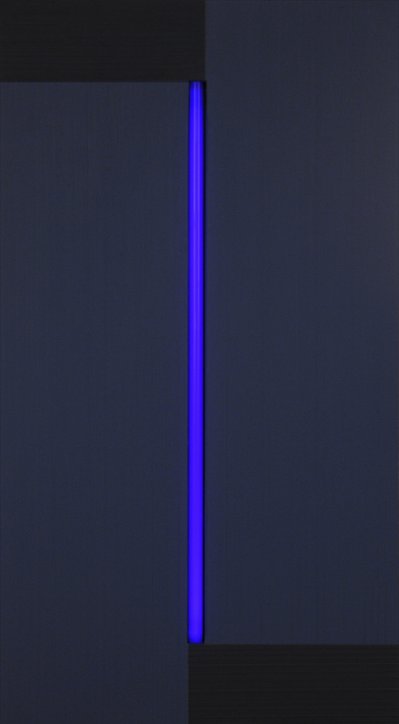

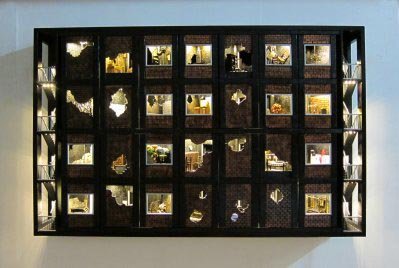

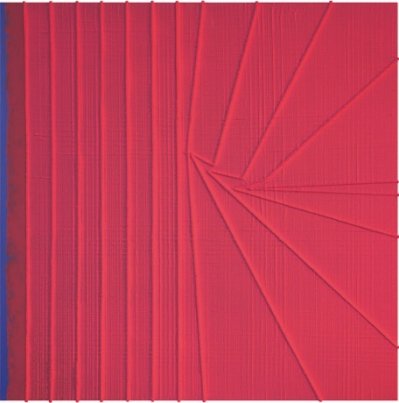

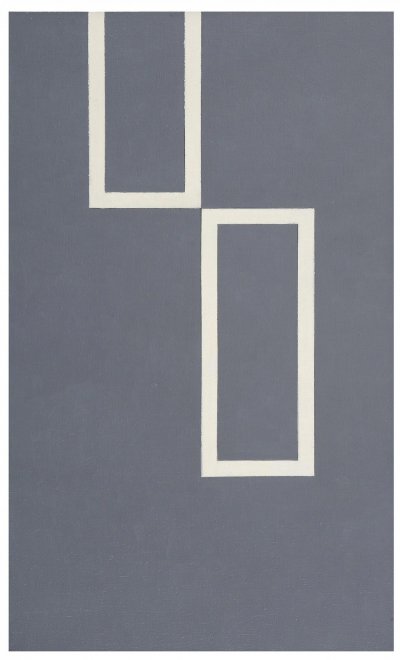

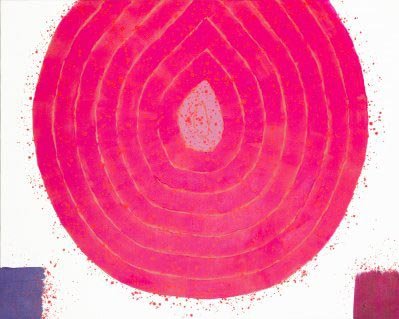

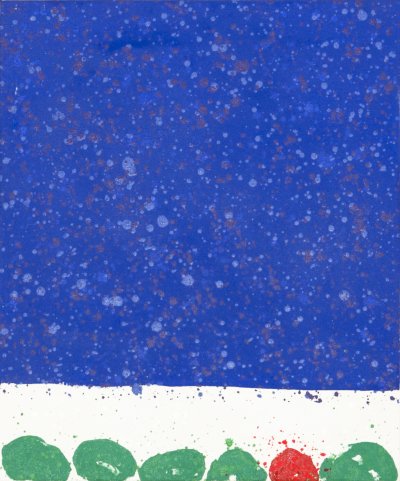

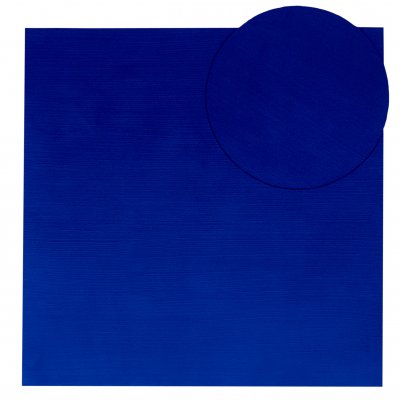

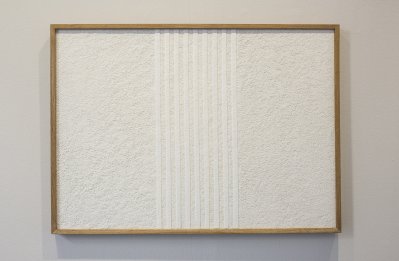

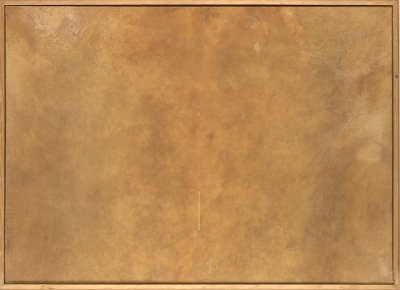

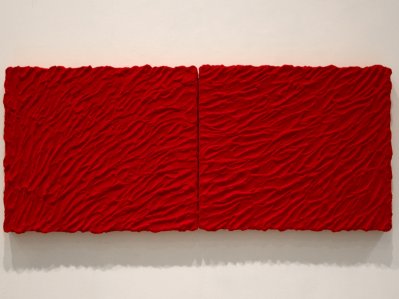

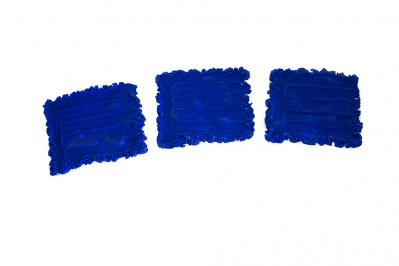

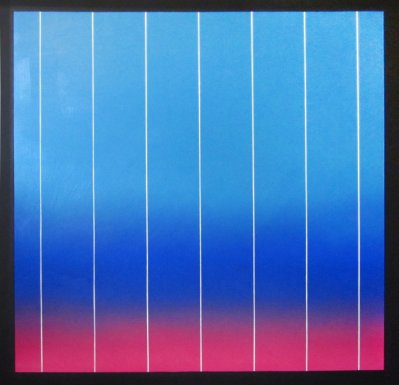

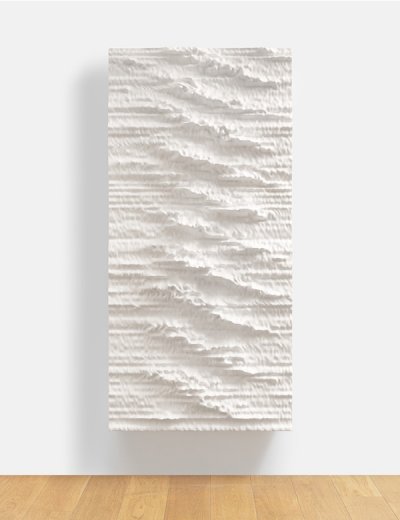

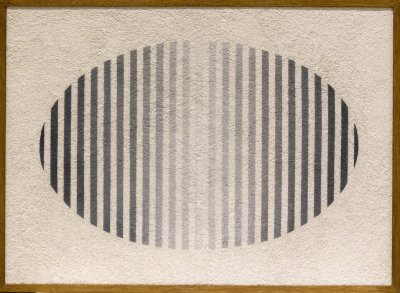

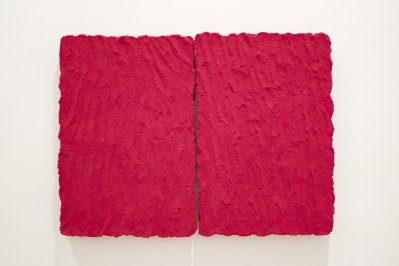

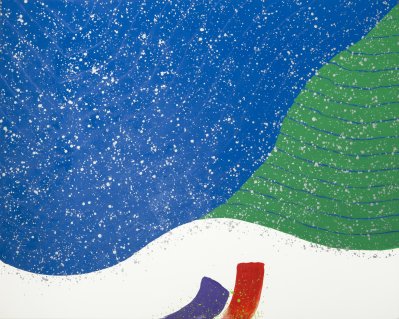

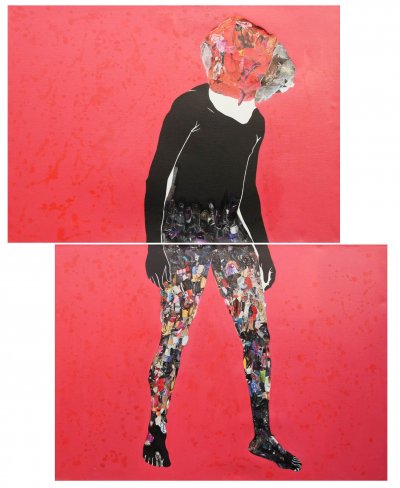

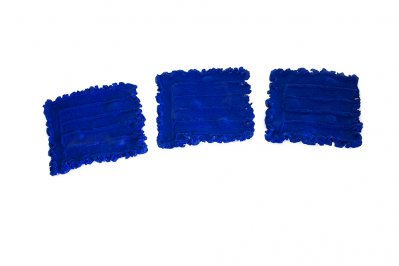

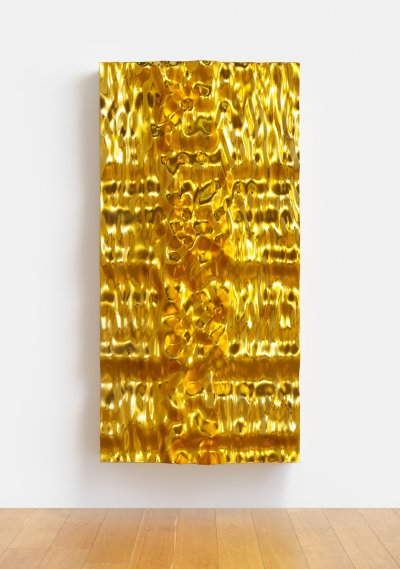

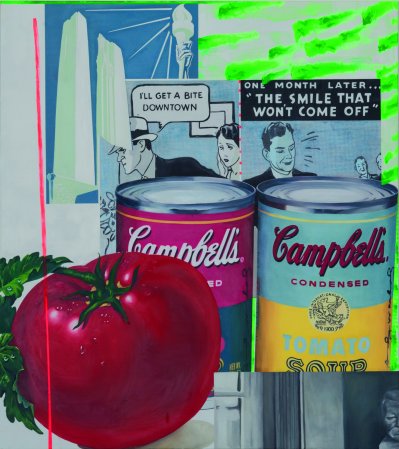

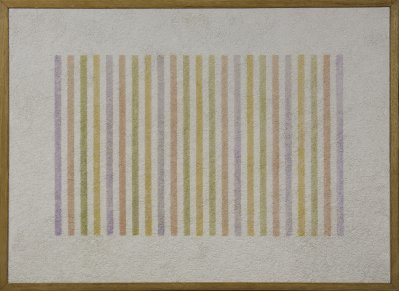

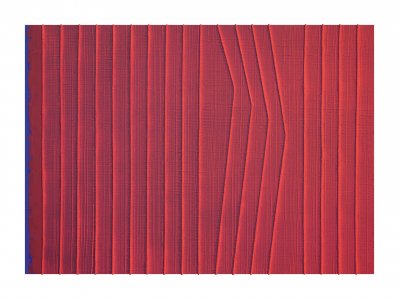

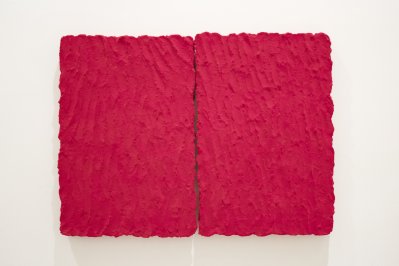

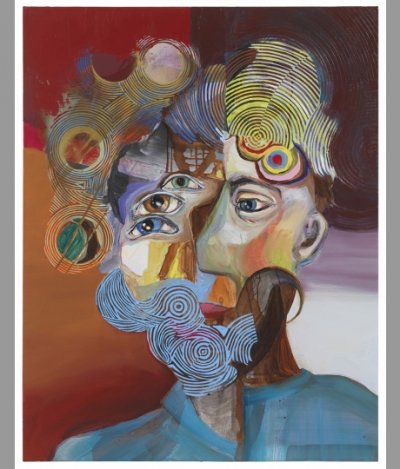

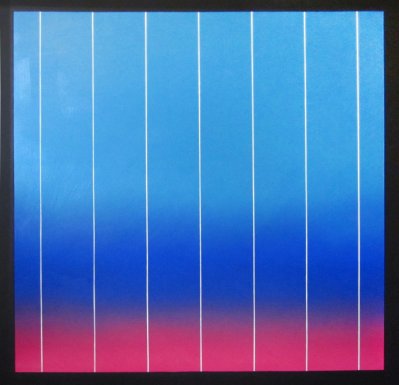

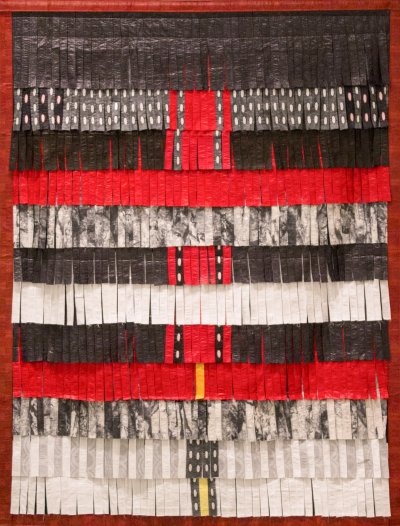

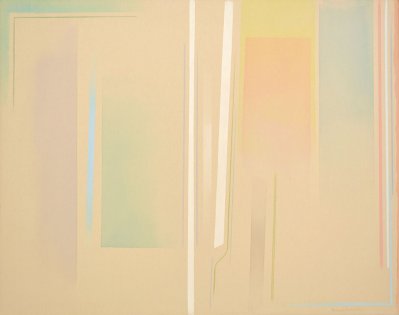

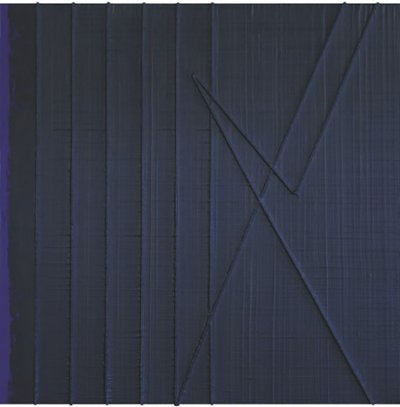

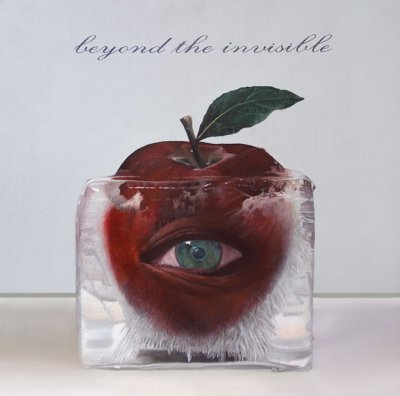

07/10/2025VAT Breakthrough for Art in Italy: 5% Reshapes the Global Market

03/10/2025

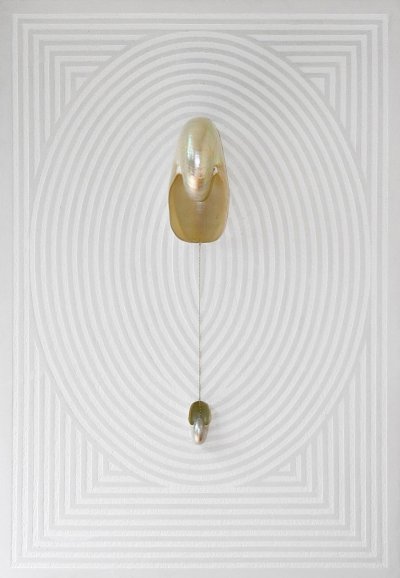

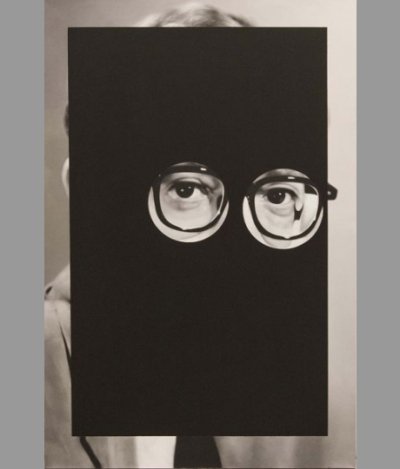

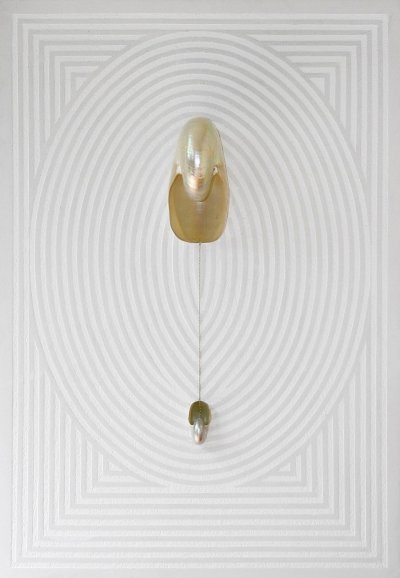

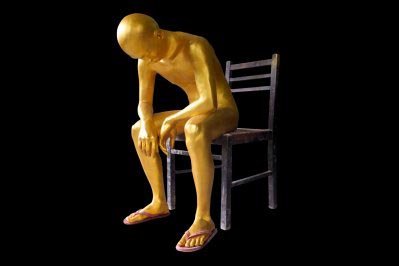

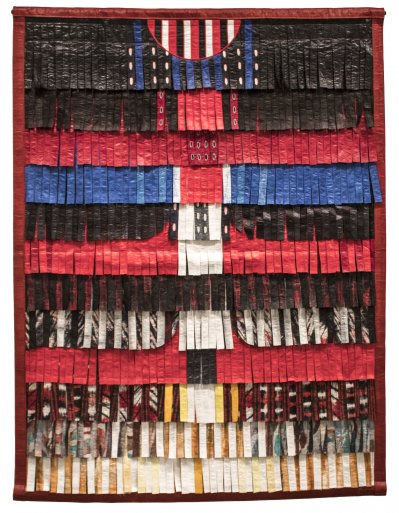

03/10/2025The Value of a Passion Asset is Not Just Financial: It is Legal.

30/09/2025

30/09/2025Vertical Reorganization of Corporate Groups: The Spin-off by Demerger

30/09/2025

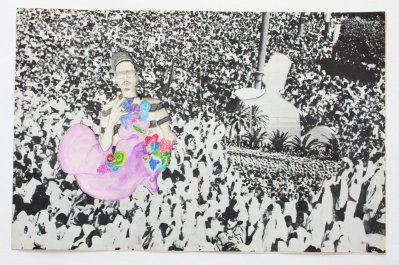

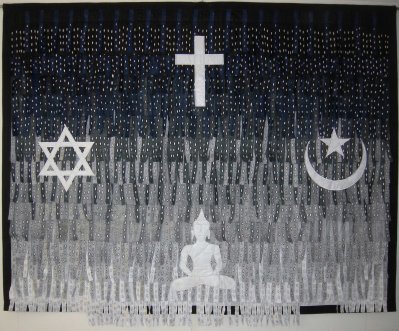

30/09/2025L’Appia dei Popoli (The Appian Way of Peoples), in Mirabella Eclano (AV), is a candidate for Italian Capital of Culture 2028, with Francesco Cascino as its Artistic Director.

15/09/2025

15/09/2025Foreign Trusts: Dividends or Capital Gains? The Italian Tax Authority Clarifies the Fiscal Boundaries in Ruling No. 144/2025

04/09/2025

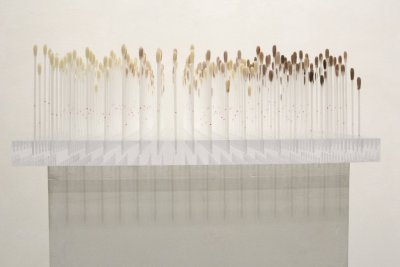

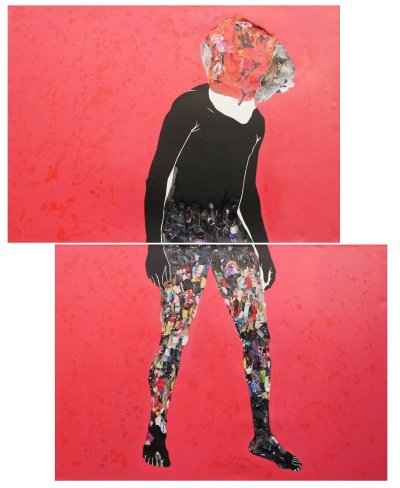

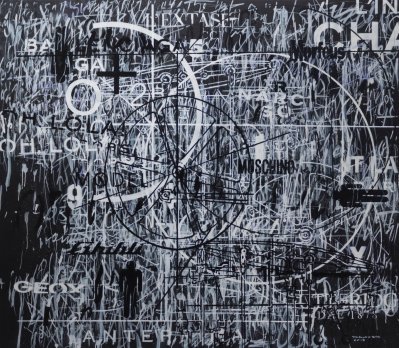

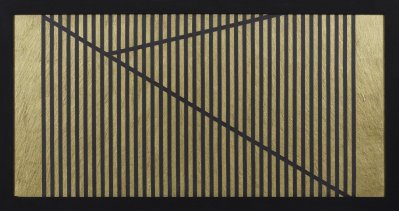

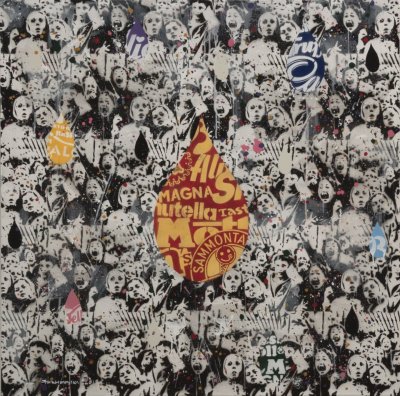

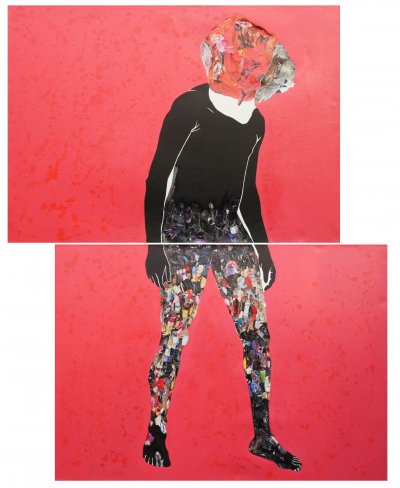

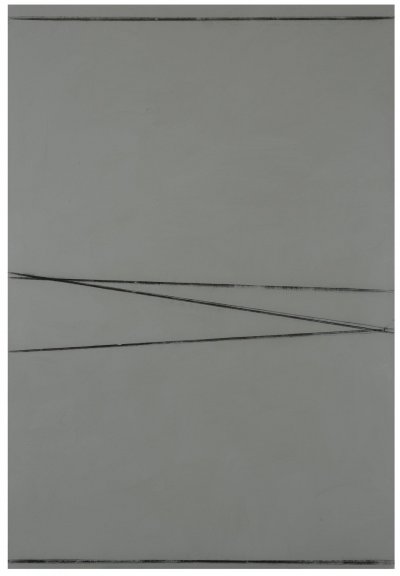

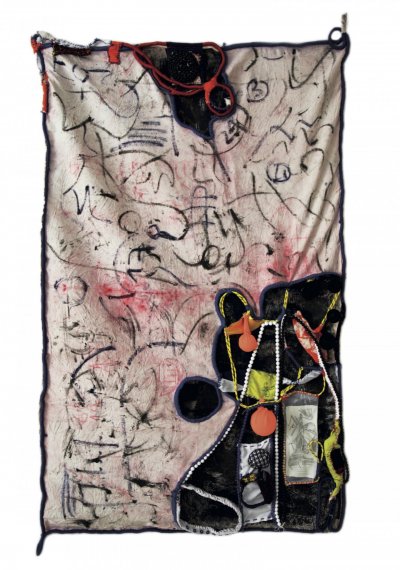

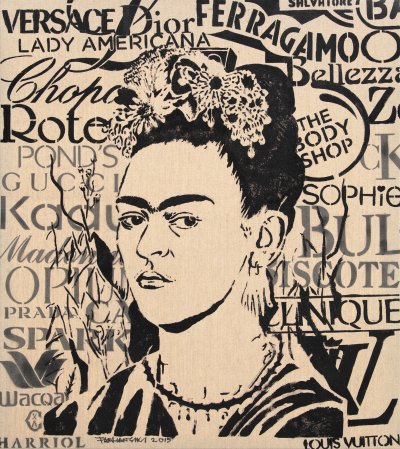

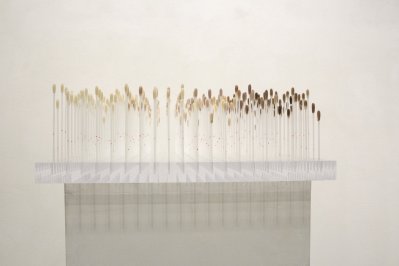

04/09/2025Art & ESG: When Paintings Speak Governance

28/08/2025

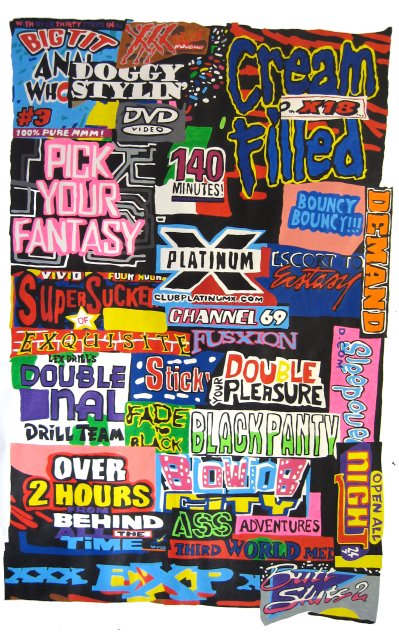

28/08/2025Art, Value and Vision: Strategies for Investing in Contemporary Art

27/08/2025

27/08/2025Cross-Border Commuters and Swiss GmbHs (SAGL): A Still Open Conflict of Income Tax Qualification

31/07/2025

31/07/2025Cross-Border Commuters and Swiss GmbHs (SAGL): A Still Open Conflict of Income Tax Qualification

31/07/2025

31/07/2025The Saudi market is undergoing a major transformation

24/07/2025

24/07/2025Saudi Arabia: Opportunities for Investors.

15/07/2025

15/07/2025INPS Pensions and Swiss Residency: The Cassation Court Confirms the Right to Reimbursement

04/07/2025

04/07/2025Carried Interest and the Risk of Reclassification as Employment Income

03/07/2025

03/07/2025Artificial Intelligence Strengthens Tax Authorities' Power in Audits

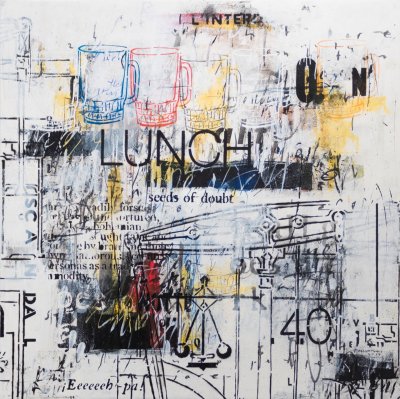

01/07/2025

01/07/2025Strategic Wealth Management and Value Enhancement

26/06/2025

26/06/2025Transfer of Assets between Trusts: Clarifications from the Revenue Agency

12/06/2025

12/06/2025New TEF Regulation

03/04/2025

03/04/2025Revaluation of Shares, Leveraged Cash Out, and Abuse of Rights

12/03/2025

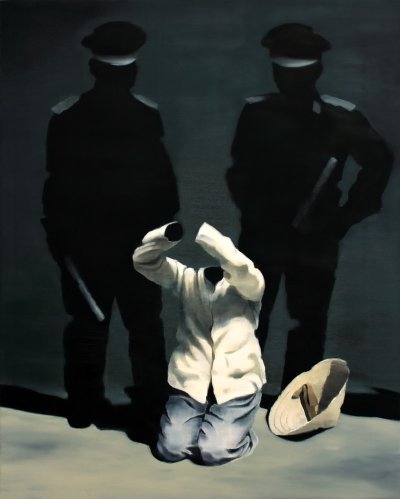

12/03/2025New Legislative Provisions on Abusive Bankruptcies

05/03/2025

05/03/2025Luxembourg attracts talent: new tax regime for impatriate workers in 2025

28/02/2025

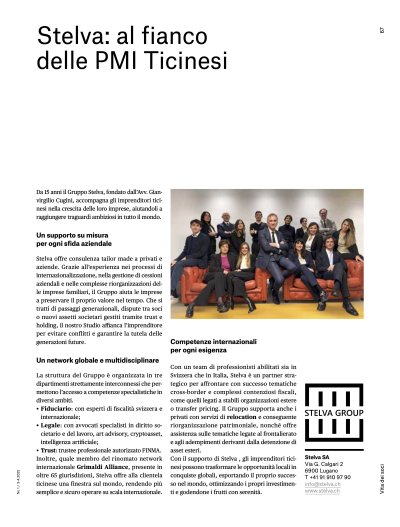

28/02/2025Stelva: alongside Ticino's small and medium-sized enterprises

05/02/2025

05/02/2025Italy-Switzerland frontier workers: the news on taxes, smart working and wages

23/01/2025

23/01/2025Italy and cryptocurrencies: new regulations changing the fiscal game

21/01/2025

21/01/2025Exemption from Italian inheritance and gift tax also for holding companies

27/12/2024

27/12/2024Lugano challenges Italy on cryptocurrencies

26/11/2024

26/11/2024Concept of tax residence and practice followed by the Italian Revenue Agency

19/11/2024

19/11/2024Retroactive purchases in pillar 3a: opportunities from 2026

05/11/2024

05/11/2024New Tax Regime for Frontier Workers from 2024

25/10/2024

25/10/2024Art Collectors: Tax Implications of Judgment No. 19363/2024

16/10/2024

16/10/2024Testamentary trusts and taxes: clarifications from the Revenue Agency

15/10/2024

15/10/2024Cassation: stop double taxation for workers abroad

09/10/2024

09/10/2024Nicola Bulgari's begins to prepare the succession through Trusts

08/10/2024

08/10/2024The repayment of foreign taxes on a Swiss resident's pension

04/10/2024

04/10/2024New moratory and remunerative Interest Rates for Federal Taxes

04/09/2024

04/09/2024New simplified Italian tax regulation for Exchanges of Shares through Contribution

26/08/2024

26/08/2024Trusts: between Inbound and Outbound taxation

20/08/2024

20/08/2024Inheritance and gift tax. Towards an extension of the facility?

10/08/2024

10/08/2024Italy's flat tax on High-Net-Worth Individuals doubles

04/07/2024

04/07/2024New FATCA agreement between the U.S. and Switzerland

18/06/2024

18/06/2024Referendum in Ticino: new facilities for taxpayers

12/06/2024

12/06/2024Res-Non-Dom UK: End of Favorable Tax Regime Expected by 2025

03/06/2024

03/06/2024The Italian - Panamanian Chamber of Commerce is born.

22/05/2024

22/05/2024“Inbound” taxation : an opportunity for the Trust

07/05/2024

07/05/2024FRONTIER WORKERS AND LIMITED LIABILITY COMPANIES: UPDATES FROM BERNE

29/02/2024

29/02/2024TERRITORIALITY IN ITALY OF DONATION ACTS CARRIED OUT BY A SUBJECT RESIDING IN SWITZERLAND

30/01/2024

30/01/2024ZENITH: PIONEERS IN ITALY IN SECURIZATION ON BLOCKCHAIN

25/01/2024

25/01/2024TRUST AND RETROCESSION OF ASSETS: TAX NEUTRALITY AND IMPACT ON BENEFICIARIES

14/12/2023

14/12/2023ACTIVITIES OF THE REGISTRY OF EFFECTIVE HOLDERS IN ITALY SUSPENDED UNTIL SPRING

03/05/2023

03/05/2023UBER REQUIRED TO PAY OASI CONTRIBUTIONS FOR SWISS DRIVERS

28/04/2023

28/04/2023SWITZERLAND AND ITALY REACH AN UNDERSTANDING: SWITZERLAND WILL BE TAKEN OFF THE ITALIAN BLACK LIST

23/12/2022

23/12/2022HELVETIA TRUST COMPANY SA SUCCESSFULLY OBTAINS FINMA AUTHORIZATION

28/10/2022

28/10/2022NEWS IN THE FIELD OF TRUST AND TAXATION OF BENEFICIARIES

25/10/2022

25/10/2022ITALIAN SUPREME COURT: TAX CREDIT ON FOREIGN-SOURCE DIVIDENDS

23/09/2022

23/09/2022ITALIAN CRYPTOCURRENCY STAKING TAXATION

15/06/2022

15/06/2022SWISS SMES: FROM 2023 EASIER TO TAKE OVER THE FAMILY BUSINESS

25/05/2022

25/05/2022VAT: AFC MUST PROVE THE NON-CONGRUITY OF PROPERTY RENTALS WITH RESPECT TO MARKET VALUE

13/05/2022

13/05/2022DO YOU WANT TO MOVE TO SWITZERLAND?

30/03/2022

30/03/2022BREXIT: ITALIAN WITHHOLDING TAX ON LOAN INTEREST

11/03/2022

11/03/2022SWISS SUCCESSION AGREEMENT AND HEIR RESIDENT IN ITALY

16/02/2022

16/02/2022ITALIAN SPECIAL TAX REGIME OF INBOUND WORKERS FOR WORKERS WHO CARRY OUT SMART-WORKING ACTIVITIES IN ITALY FOR A SWISS EMPLOYER

11/02/2022

11/02/2022THE REQUALIFICATION OF LOANS GRANTED BY A COMPANY TO ITS SHAREHOLDER

04/02/2022

04/02/2022TRANSFER OF SHAREHOLDINGS REVALUED IN THE PRESENCE OF EARN-OUT CLAUSES

29/12/2021

29/12/2021THE METAVERSE COULD BE AN OPPORTUNITY TO ADOPT NATIONAL CRYPTO COINS

22/12/2021

22/12/2021THE NEW AGREEMENT BETWEEN SWITZERLAND AND ITALY ON THE TAXATION OF FRONTIER WORKERS WILL BE IN FORCE FROM 2023

26/11/2021

26/11/2021THE SWISS VAT TERRITORIALITY IN TRANSACTIONS WITH OFFSHORE COMPANIES

18/11/2021

18/11/2021PARTICIPATIONS’ ATTRIBUTION TO TRUST BENEFICIARIES DO NOT REDUCE THE THRESOLDS

16/07/2021

16/07/2021ITALIAN TAX ASPECTS REGARDING NFT AND CRYPTOART

02/07/2021

02/07/2021TAX CREDIT IN ITALY FOR TAXES PAID IN SWITZERLAND

11/06/2021

11/06/2021GOOGLE OPENS TO MED DATA

04/06/2021

04/06/2021CRYPTOCURRENCIES, MEF AND UE SITUATION

06/04/2021

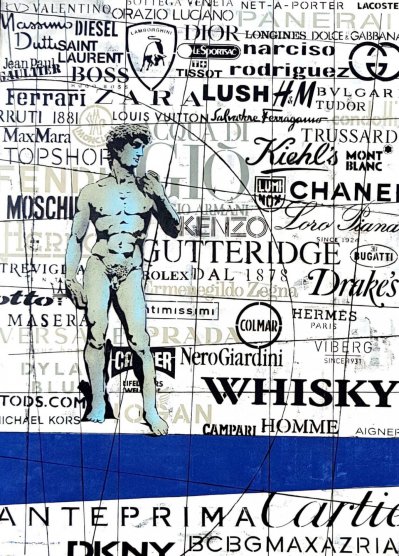

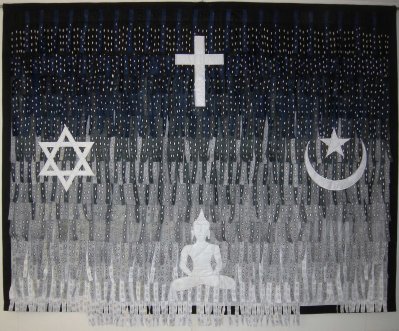

06/04/2021ARTEPRIMA: CURA CULTURA PROJECT

23/02/2021

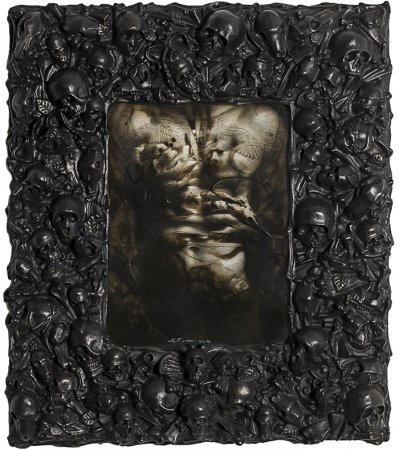

23/02/2021TRUSTS FOR THE PROTECTION AND TRANSMISSION OF ARTISTIC ASSETS

11/01/2021

11/01/2021BREXIT AND FREE MOVEMENT OF PERSONS SWITZERLAND-UNITED KINGDOM

04/01/2021

04/01/2021TRANSFER PRICING: NEW ITALIAN GUIDELINES FOR ARM’S LENGTH PRINCIPLE PRACTICAL APPLICATION

28/12/2020

28/12/2020PATERNITY LEAVE

14/12/2020

14/12/2020PUBLISHED IN THE OFFICIAL GAZETTE THE IMPLEMENTING DECREE FOR THE SUPPORT TO INNOVATIVE STARTUPS AND SMES

07/12/2020

07/12/2020SUPPLEMENTARY BENEFITS 2021: WHAT CHANGES?

01/12/2020

01/12/2020FOR ITALIAN TAX AUTHORITY THE CARRIED INTEREST PROFIT HAS TO BE ANALYZED CASE BY CASE

24/11/2020

24/11/2020ITALY, REDUCED VAT RATE OF 10% AND ARTWORKS

03/11/2020

03/11/2020TAX TREATMENT FOR WAGES PAID TO ITS SWISS-SECONDED STAFF BY AN ITALIAN COMPANY

19/10/2020

19/10/2020RW FORM ALSO FOR “PEER TO PEER LANDING” PLATFORMS’ OPERATIONS

12/10/2020

12/10/2020ITALY, TRUST AND GIFT TAX: THE LATEST CASE-LAW BASIS

14/09/2020

14/09/2020ITALIAN INDIRECT TAXATION IN THE ISSUE OF UTILITY TOKENS

07/09/2020

07/09/2020WITH THE BLOCKCHAIN TECHNOLOGY THE ITALIAN TRUST BECOMES EVEN SAFER

31/08/2020

31/08/2020ABUSE OF LAW WITHIN DIVIDENDS DISTRIBUTIONS

10/08/2020

10/08/2020PRIVACY, GREEN LIGHT TO BODY TEMPERATURE MONITORING

27/07/2020

27/07/2020CAMPARI TO MOVE REGISTERED OFFICE TO THE NETHERLANDS BY THE END OF JULY

01/07/2020

01/07/2020UNLOCK - THE SERVICE FOR BUYING INNOVATIVE COMPANIES

11/03/2020

11/03/2020THE NEW ITALIAN TAX WEB

14/01/2020

14/01/2020Swiss Accounts under Italian Tax Authority’s investigation

09/01/2020

09/01/2020STELVA ANNOUNCES A DISTRIBUTION AGREEMENT WITH BV4 FOR STARTUP EVALUATION SERVICES

28/11/2019

28/11/2019IN ITALY: REVALUATION OF SHARES AND LAND WITH 11% SUBSTITUTE TAX

20/11/2019

20/11/2019TRANSFER OF ASSET TO A CHARITY TRUST: IN ITALY APPLICABLE IN HERITANCE AND GIFT TAX

13/11/2019

13/11/2019STELVA ANNOUNCES A PARTNERSHIP AGREEMENT WITH FIDELITY HOUSE INTERNATIONAL FOR BLOCKCHAIN-TIMESTAMP SERVICES

08/11/2019

08/11/2019INCREASE IN VALUE OF CORPORATE SHAREHOLDINGS

31/10/2019

31/10/2019GIANVIRGILIO CUGINI SPEAKER FOR THE “ADRIANO OLIVETTI DAY 2019”

30/10/2019

30/10/2019“RUSSIAN ROULETTE CLAUSE”

23/10/2019

23/10/2019FRAMEWORK OF THE ACQUISITION/SELLING OF CRYPTOCURRENCIES FOR THE PURPOSES OF THE VALUE-ADDED TAX

16/10/2019

16/10/2019USA: GREEN LIGHT TO THE EXCHANGE OF INFORMATION WITH SWITZERLAND

10/10/2019

10/10/2019GIANVIRGILIO CUGINI SPEAKER FOR THE OAD FCT TRAINING DAYS

02/10/2019

02/10/2019V EU ANTI-MONEY LAUNDERING DIRECTIVE: GREEN LIGHT TO THE IMPLEMENTING DECREE

28/08/2019

28/08/2019ITALIAN TAXATION FOR COMPANIES RESIDING ABROAD

21/08/2019

21/08/2019THE ITALIAN TAX AGENCY REQUIRES ADMINISTRATIVE ASSISTANCE TO SWITZERLAND FOR UBS CUSTOMERS 2015 AND 2016

14/08/2019

14/08/2019INHERITANCE: THE COMPANY'S VALUE DEPENDS ON THE HEIRS’ CHOICES

07/08/2019

07/08/2019NEW LETTERS FROM THE REVENUE AGENCY FOR NON-DECLARED INCOME

17/07/2019

17/07/2019INNOVATIVE RESPONSES VIA LEGAL DESIGN

21/06/2019

21/06/2019THE ANTI-TAX AVOIDANCE DIRECTIVE (ATAD) AND THE NEW EXIT TAX REGULATION IN ITALY

31/05/2019

31/05/2019ITALY: CLARIFIED THE TRUSTEE OBLIGATION FOR THE FISCAL MONITORING

24/05/2019

24/05/2019NEWS FOR THE VAT IN EU

20/05/2019

20/05/2019WITHOLDING EXEMPTION FOR DIVIDEND PAYMENTS TO THE SWISS HOLDING

14/05/2019

14/05/2019TRANSFER PRICING RULES AGAINS ELUSIVE INTRAGROUP ACTIVITY

03/05/2019

03/05/2019NEWS SAN MARINO LEGISLATION ON BLOCKCHAIN

24/04/2019

24/04/2019AVV. CUGINI SPEAKER FOR BONSIGNORI INSTITUTE

18/04/2019

18/04/2019ITALY BECOMES RICHER WITH THE EXCHANGE OF INFORMATION

24/04/2019

24/04/2019GUIDE TO IDENTIFICATE THE BENEFICIAL OWNERS

05/04/2019

05/04/2019EFFECTS OF THE USA SALES TAX REGULATIONS ON ITALIAN COMPANIES SELLING IN THE USA

21/03/2019

21/03/2019THE CONNECTING FACTORS OF PERMANENT ESTABLISHMENTS: THE ITALIAN CASE-LAW

19/03/2019

19/03/2019FOR THE CJEU THE FISCO SHALL DEMONSTRATE THE ABUSE OF EU LAW

01/03/2019

01/03/2019STELVA PROFESSIONALS SPEAKERS FOR THE CONFERENCE: NEW LEGAL LIABILITY FOR THE TRUSTEE: RECENT CASE STUDIES

25/02/2019

25/02/2019The Carried interest: Italian taxation and the verification of disposition of income

15/02/2019

15/02/2019LUXEMBOURG: THE NAMES OF BENEFICIAL OWNERS BECOME PUBLIC

01/02/2019

01/02/2019SWISS COMPANIES: NEW GUIDELINES ABOUT TELEVISION TAX

25/01/2019

25/01/2019TRUST: TAXATION AFTER PATRIMONIAL INCREASE

18/01/2019

18/01/2019THE SWISS TAXPAYER, VAT NUMBER HOLDER IN ITALY, RISK THE TAXATION IN ITALY

14/01/2019

14/01/2019THE NORTH AMERICAN BITCOIN CONFERENCE

10/01/2019

10/01/2019THE NEW REPORT OF THE FEDERAL COUNCIL ABOUT BLOCKCHAIN AND DLT TECHNOLOGIES

03/01/2019

03/01/2019THE SITE MANAGER IS JOINTLY- RESPONSIBLE FOR THE DATA PROCESSING

19/12/2018

19/12/2018THE NEW STANCE IN TERMS OF CRIPTOCHURRENCIES

23/11/2018

23/11/2018OECD: A REINFORCED CONTROL ABOUT THE RESIDENCES EASILY OBTAINED

21/11/2018

21/11/2018THE COURT OF APPEAL OF BRESCIA SLOW DOWN THE CRYPTOCURRENCIES CONFERRAL

05/11/2018

05/11/2018STELVA PROFESSIONALS SPEAKERS FOR THE CONFERENCE: 52° F.A.R.O MEETING

02/11/2018

02/11/2018STELVA PROFESSIONALS SPEAKERS FOR THE CONFERENCE: FROM GOLD TO BITCOIN

02/11/2018

02/11/2018THE FEDERAL LAW ON TAX REFORM AND THE AVS LOAN

19/10/2018

19/10/2018UTILITY TOKENS: THE TAX REGIME IN ITALY

12/10/2018

12/10/2018STELVA PROFESSIONALS SPEAKERS FOR THE CONFERENCE ABOUT PERSONAL DATA PROTECTION AND REGULATION GDPR

12/10/2018

12/10/2018SWITZERLAND: ECHANGED DATA ABOUT TWO MILLION OF ACCOUNTS

09/10/2018

09/10/2018SWITZERLAND: THE FIRST CRYPTOBANK

05/10/2018

05/10/2018MAIL ORDERS ARE SUBJECTED TO SWISS VAT

04/10/2018

04/10/2018STELVA PROFESSIONALS SPEAKERS FOR THE CONFERENCE WEBINAR: CRIPTOCURRENCIES AND ICO

14/09/2018

14/09/2018SWITZERLAND REJECTED THE LEGAL ASSISTANCE FOR FISCAL VIOLATIONS, BUT THE INFORMATION EXCHANGE WITH ITALY REMAIN OPERATIVE

05/09/2018

05/09/2018STELVA PROFESSIONALS SPEAKERS FOR THE CONFERENCE INNOVA

03/09/2018

03/09/2018THE CHANGES TO THE CFC (CONTROLLED FOREIGN COMPANIES REGIME)

29/08/2018

29/08/2018DENIAL BY THE ITALIAN JUDGE TO THE PROVISION OF CRYPTOCURRENCIES

16/08/2018

16/08/2018BANK ACCOUNTS HELD IN SWITZERLAND BY FOREIGN RESIDENTS: INTRASMISSIBILITY OF THE NAMES

22/08/2018

22/08/2018SIX AND THE NEW DIGITAL ASSET PLATFORM

08/08/2018

08/08/2018USA: OFFSHORE PROFITS REDUCTION

31/07/2018

31/07/2018REDUCTION OF RESTRAINT ON EU DIVIDENDS

24/07/2018

24/07/2018CONVENIENCE OF THE RELEASE OF THE CAPITAL GAIN DERIVING FROM QUALIFIED PARTECIPATIONS

17/07/2018

17/07/2018THE V DIRECTIVE ABOUT ANTI-MONEY LAUNDERING AND LIMITATIONS OF GDPR

09/07/2018

09/07/2018FISCAL SGRAVES FOR INNOVATIVE START-UP IN TICINO

04/07/2018

04/07/2018INTERMEDIARIES AND AGGRESSIVE TAX PLANNING

28/06/2018

28/06/2018CRIPTOVALUTE:PROJECTS INHERENT TO THE DEFINITION OF VAT PRACTICE

22/06/2018

22/06/2018MINI-VOLUNTARY: PAY ATTENTION TO THE PENAL ASPECTS

18/05/2018

18/05/2018Stelva professionals speaker for the conference: Big data and Blockchain - a day of study

27/04/2018

27/04/2018Blockchain, ICO and Token Economy (Swiss and Italian legislation) : Dr. Bonaldo speaker for Cripto Valley Association

23/04/2018

23/04/2018Switzerland possible headquarters of Bitfinex

18/04/2018

18/04/2018News about cryptocurrencies in Italy

09/04/2018

09/04/2018Blockchain e Ico: Dr. Bonaldo speaker for Bocconi University

03/04/2018

03/04/2018Italian Fiscal Agency: new checks on the taxpayers who have not joined the VD program

27/03/2018

27/03/2018Italy: news about dividend taxation from “black list” countries

20/03/2018

20/03/2018The new OECD Model of the Double Taxation Convention

08/03/2018

08/03/2018LE CRYPTOVALUTE: It's not a Far West! - The Lawyer Cugini speaker at the convention organized by JCI (Junior Chamber International)

06/03/2018

06/03/2018News on Transfer pricing

02/03/2018

02/03/2018Bern: the results of genetic tests must not be disclosed

22/02/2018

22/02/2018U.S TAX REFORM: OPPORTUNITIES FOR THE INTERNATIONALIZATION OF ENTERPRISES

20/02/2018

20/02/2018Non-definitive transfers of assets to a trust and indirect tax.

16/02/2018

16/02/2018Arte and Blockchain meet on 24 February 2018 at the MO.CA of Brescia

13/02/2018

13/02/2018The competence center for the Blockchain is born in Lugano

09/02/2018

09/02/2018New European data protection regulations: possible implications for Swiss companies.

08/02/2018

08/02/2018Switzerland's economics minister: "we must become a crypto-nation"!

06/02/2018

06/02/2018MEF: The public consultation on the draft decree to censure the phenomenon of virtual currencies starts.

02/02/2018

02/02/2018Passing on the art: trust and foundation

29/01/2018

29/01/2018Cryptocurrencies and Blockchain: Avv. Cugini speaker for Supsi

26/01/2018

26/01/2018Acceptance of the inheritance “with reserve” does not exempt the heir from liability for the payment of the de cuius tax.

24/01/2018

24/01/2018Avv. Cugini Trainee for the conference Alfio Bardolla Training Group

23/01/2018

23/01/2018Transactions with blacklist companies:

and of the proofs in order to obtain cost deductibility.  23/01/2018

23/01/2018Gran Consiglio approved the increase of checks on work permits

19/01/2018

19/01/2018Establishment of a working group dedicated to blockchain’s technology and ICOs.

16/01/2018

16/01/2018Fine issued in Switzerland by a citizen resident on Italian territory: why it is appropriate to pay.

10/01/2018

10/01/2018Voluntary disclosure permits the reimbursement of the Euroritenuta

07/01/2018

07/01/2018Switzerland’s vat: new obligations for Italian companies

22/12/2017

22/12/2017On Trust&Wealth Management Journal an article by Avv. Cugini

18/12/2017

18/12/2017Success for Block and Roll

14/12/2017

14/12/2017Block and Roll - a conference about cryptocurrencies and block chain

04/12/2017

04/12/2017 29/11/2017

29/11/2017The TRAM approves an appeal against the LIA registration

20/11/2017

20/11/2017Switzerland approves the ordinance on the country by country report

17/11/2017

17/11/2017With judgment no. 19376/2017 the Italian Supreme Court of Cassation returns to pronounce on trust

09/11/2017

09/11/2017Incoming taxes on capital gains from the sale of the art works

07/11/2017

07/11/2017Corriere del Ticino: an article about the conference "Criptocurrencies: what law?"

06/11/2017

06/11/2017New Italian law on the transposition of Mifid2 and Mifir

30/10/2017

30/10/2017Published the MEF Decree on changes to the US-Italy Agreement for Automatic Information Exchange

20/10/2017

20/10/2017Tax Project 17: Switzerland starts the consultation

12/10/2017

12/10/2017New percentages of taxability for dividends and capital gains in Italy

09/10/2017

09/10/2017Enforced fiscal monitoring for fake residences abroad

06/10/2017

06/10/2017Lawyer Cugini speaker about cryptocurrencies

05/10/2017

05/10/2017Regulation of ICOs under the law of supervision

28/09/2017

28/09/2017Automatic information exchange is now a concrete reality for Italy

20/09/2017

20/09/2017To introduce the drag along clause in the statute in Italy it is necessary have the majority

15/09/2017

15/09/2017The tax advantages of donating real estate in Italian law

31/07/2017

31/07/2017Swiss bank Account checked by Italian Tax Authorities

31/07/2017

31/07/2017Recognition of double tax treaty benefits to Passive Holding

31/07/2017

31/07/2017Automatic Exchange Information

18/07/2017

18/07/2017Responsibility of the Director in the company

18/07/2017

18/07/2017Automatic Exchange of Information in tax matter

18/07/2017

18/07/2017Switzerland: New change in VAT Laws

30/06/2017

30/06/2017Foreign Tax Credit refund for who apply to Voluntary Disclousure

13/06/2017

13/06/2017Italy: Facilitations for foreign rich person

13/06/2017

13/06/2017Italy: Remove patent registered in foreign country

13/06/2017

13/06/2017Italy: Exemption of donation and inheritance tax for neo –residents who have assets abroad

13/06/2017

13/06/2017Europe: European trademark

07/06/2017

07/06/2017The agreement on the Automatic Exchange of Financial Account Information between Italy and Hong Kong was signed

30/05/2017

30/05/2017The facilities for workers transferring their tax residence from abroad to work in Italy

16/05/2017

16/05/2017Permanent Estabilishment: Amazon’s case

02/05/2017

02/05/2017Dubai will exchange financial and tax information

27/04/2017

27/04/2017The Transfer Price adapts to OECD guidelines

24/04/2017

24/04/2017Italy - Liechtenstein: Imminent Exachange Information

03/04/2017

03/04/2017Cross-border transfer of shares: The Case of Italy and France

22/03/2017

22/03/2017Group Request on “recalcitrant” italian citizens

20/03/2017

20/03/2017The Project Beps (base erosion and profit shifting) is operational

10/03/2017

10/03/2017Avv. Gianvirgilio Cugini and Dott.ssa Arianna Bonaldo, speakers for Organismo di Autodisplina OAD FCT of the Trustees of the Canton Ticino

06/03/2017

06/03/2017Abroad use of a company vehicle by employees domiciled in Italy

03/03/2017

03/03/2017Relocation in Switzerland under control of the Italian Tax Authority

01/03/2017

01/03/2017Cypriot company without business substance are watched by foreign tax authorities

30/01/2017

30/01/2017"Res non Dom": New system of rewards for individuals who transfer their residence in Italy

23/01/2017

23/01/2017The American and Chinese Giants expand in Switzerland

20/01/2017

20/01/2017Voluntary Disclosure bis: tight control of the Treasury for taxpayers who moved abroad

09/01/2017

09/01/2017Voluntary Disclosure Form

10/06/2016

10/06/2016Automatic Exchange Of Information: Switzerland Signed An Agreement With The European Union And Australia

17/02/2016

17/02/2016Significant influence and control! Who is the beneficial owner?

07/01/2016

07/01/2016Belgium – New Transparency Tax

15/01/2015

15/01/2015Comparison on sole trader taxation

12/05/2014

12/05/2014Switzerland seduces e-commerce

15/02/2014

15/02/2014Swiss companies forms

15/01/2014

15/01/2014Comparison between sole trader and SAGL taxation

01/01/2014

01/01/2014Business networks contracts

30/08/2013

30/08/2013News on trade relationship between Switzerland and China